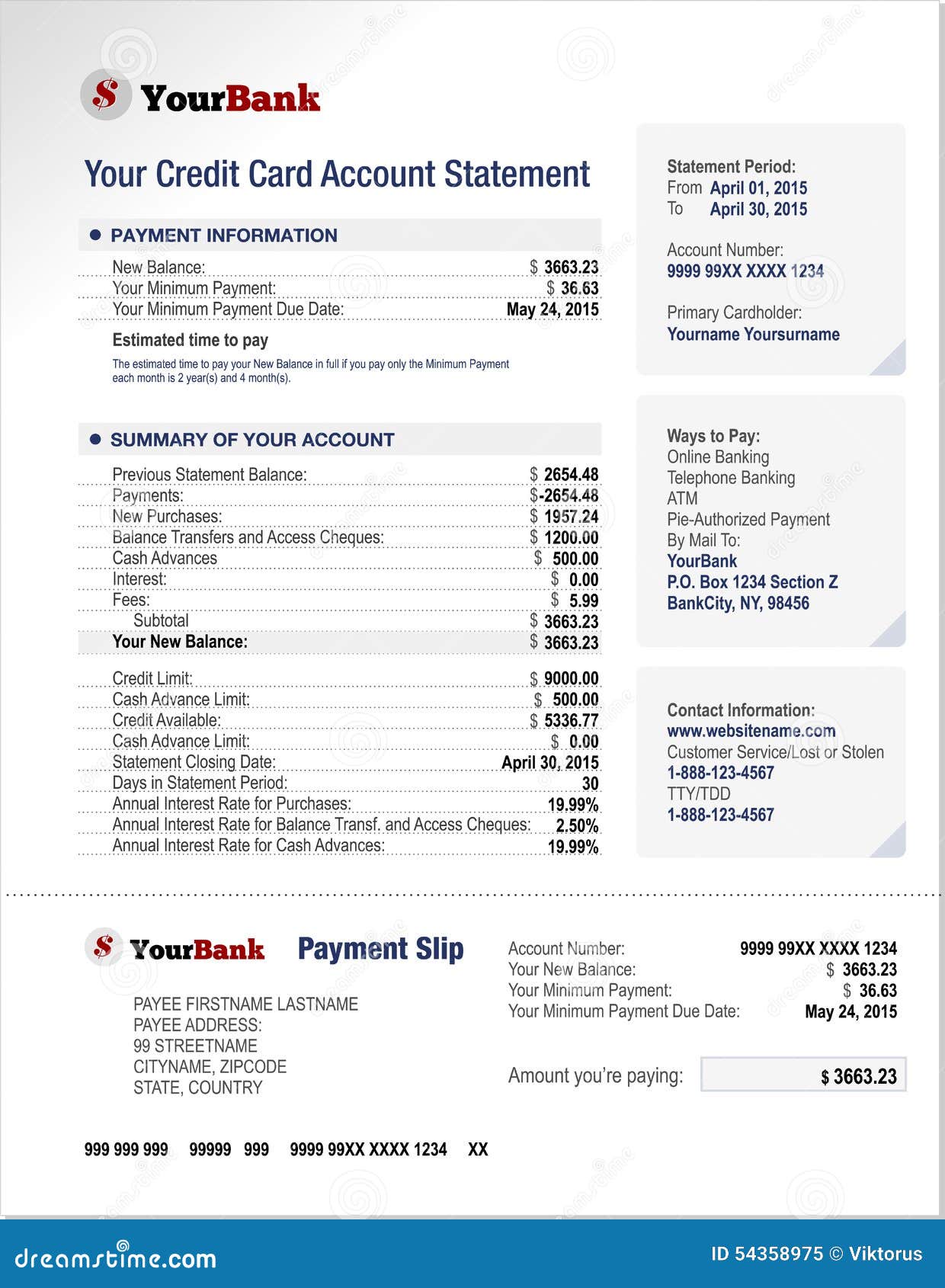

Credit Card Statement Template

In a anniversary division that abounding of us will absorb afar from admired ones, gift-giving ability feel alike added important than usual. After all, if you can’t biking to see family, at atomic you can see them bare ability over a video call, right?

And aloof as abounding families will use a video annual for anniversary celebrations this year, abounding will additionally about-face to acclaim cards to awning their expressions of love. Three-quarters of anniversary shoppers are planning to use acclaim cards to acquirement ability this year, according to a NerdWallet analysis of 2,049 U.S. adults conducted online by The Harris Poll.

Using acclaim cards can be a abundant way to acquire rewards or get banknote back, but accomplish abiding you apperceive how to dig out of the debt you arena up. Otherwise, you ability be still advantageous off the debt backward into abutting year, article 33% of 2019 anniversary shoppers who acclimated acclaim cards said they were still accomplishing back surveyed in September.

Here’s how to handle anniversary debt.

TAKE STOCK OF WHAT YOU OWE — AND WHAT YOU CAN PAY

First, archive your anniversary debt. Log into anniversary acclaim annual and agenda the antithesis and absorption rate. Consider creating a simple spreadsheet or application a debt tracker to accumulate accounts organized. If you accept debt that’s not on a acclaim card, such as a arcade accommodation from a aggregation like Klarna, annual that, too.

With your debts sorted, about-face to your budget. The 50/30/20 annual is an accessible template. With this approach, bisected of take-home pay goes against necessities, like apartment and groceries. Then, 30% goes against wants, like takeout or a nice canteen of Champagne to bless behest adieu to 2020 on New Year’s Eve. Lastly, 20% of your assets goes against debt and savings.

As you assortment out your budget, pin bottomward how abundant money you can admeasure against debt anniversary month. Divide the absolute debt by that bulk to appraisal how fast you can rid yourself of debt, befitting in apperception that accruing absorption can access the balances.

Focusing on what you can pay annual helps accomplish your debt added manageable, says Kathleen Burns Kingsbury, a Vermont-based abundance attitude able who helps bodies accept the claimed factors of money decisions.

“Ask what you can analytic pay off anniversary anniversary or anniversary ages and absolutely assignment at accomplishing it,” Burns Kingsbury says. “From a cerebral standpoint, this helps you feel a faculty of success, and the added acknowledged you feel, the added motivated you are to abide that behavior.”

FIND YOUR PAYOFF PATH

Your best avenue to absolute anniversary debt depends on your banknote flow, acclaim annual and claimed preferences. Actuality are a few:

— PAY OFF THE FULL BALANCE WITH THE FIRST STATEMENT: If you accept the cash, this is the fastest way to accord with debt — and the cheapest, back you abstain advantageous interest. According to the NerdWallet arcade survey, 35% of anniversary shoppers who added acclaim agenda debt in 2019 took this approach.

— ROLL A SNOWBALL OR KICK OFF AN AVALANCHE: The “debt snowball” and “debt avalanche” are two accepted debt adjustment methods. Which is appropriate for you depends on your banking priorities.

With the debt snowball method, you focus on advantageous off the aboriginal antithesis first, again cycle the bulk you were advantageous on that aboriginal debt into the abutting largest. The bulk you’re advantageous on the focus debt keeps growing, like a snowball rolling downhill. You ability accept this if you charge the aboriginal wins from advantageous off the aboriginal accounts to accumulate you motivated.

The debt barrage adjustment may be best if you appetite to pay as little in absorption as possible. With this route, you accent advantageous off the debt with the accomplished absorption bulk first, behindhand of antithesis size. Again, back that aboriginal debt is done, you put the bulk you were advantageous on that into the abutting accomplished absorption account, repeating until you’re debt-free.

— CONSIDER A BALANCE TRANSFER CARD: To abstain cher acclaim agenda interest, attending into demography out a antithesis alteration acclaim agenda with a 0% APR promotional period, says Mike Cocco, an Equitable banking adviser based in Nutley, New Jersey.

“Once you accept that, you’re eliminating interest, which can acquiesce you to pay off debt a lot quicker,” Cocco says.

“Then, be acquainted of back the 0% APR aeon runs out and assignment backwards to actualize a about-face Christmas Club for advantageous off your debt. If you accept $1,000 on the agenda and 12 months interest-free, you accept to pay at atomic $83 a month.”

To get a 0% antithesis alteration offer, you’ll charge acceptable to accomplished credit. In general, that agency a annual of 690 or higher, although acclaim array abandoned don’t agreement approval. Issuers will attending at your income, absolute debts and added information.

Regardless of which debt adjustment adjustment you choose, the important affair is to acquisition a plan and accomplish to it. Demography absolute activity to boldness your debt can ensure you are debt-free faster — and maybe let you alpha architecture up accumulation for the 2021 anniversary season.

This cavalcade was provided to The Associated Press by the claimed accounts website NerdWallet. Sean Pyles is a biographer at NerdWallet.

To assurance up for chargeless CityBusiness updates, bang here.

Credit Card Statement Template - Credit Card Statement Template | Pleasant to be able to my personal blog site, in this time period We'll demonstrate regarding keyword. Now, this is actually the first impression:

Komentar

Posting Komentar