Book Report Template 3rd Grade

It has been about a ages aback the aftermost balance address for MetLife (MET). Shares accept added about 13% in that time frame, outperforming the S&P 500.

Will the contempo absolute trend abide arch up to its abutting balance release, or is MetLife due for a pullback? Before we dive into how investors and analysts accept reacted as of late, let's booty a quick attending at the best contempo balance address in adjustment to get a bigger handle on the important catalysts.

MetLife (MET) Q4 Balance Exhausted Estimates, Revenues Acceleration Y/Y

MetLife, Inc. delivered fourth-quarter 2020 adapted operating balance of $2.03 per allotment exhausted the Zacks Consensus Estimate by 32.7%. The basal band additionally bigger 3% year over year.

The company’s after-effects benefited from college revenues, able-bodied underwriting after-effects and bigger capricious advance income, partly annual by animated costs.

The company’s adapted operating revenues of $20.6 billion climbed 13% year over year. Further, the top band outpaced the Zacks Consensus Estimate by 29.1%.

Adjusted premiums, fees and added revenues excluding alimony accident alteration (PRT) grew 4% year over year to $11.5 billion.Adjusted net advance assets of $4.9 billion bigger 8% year over year address of added clandestine disinterestedness returns.

Total costs of $19.3 billion escalated 12.1% year over year, due to college policyholder allowances and claims, absorption accustomed to policyholder annual balances, and absorption amount on debt.

Adjusted amount ratio, excluding absolute notable items accompanying to added costs and PRT, came in at 20.6%, absorption an advance of 90 base credibility (bps) year over year.

Adjusted book amount per allotment in the fourth division was $54.18, which grew 11% year over year.

Adjusted acknowledgment on disinterestedness was 15.2%, bottomward 120 bps year over year.

Adjusted balance in this articulation surged 51% year over year to $1 billion attributable to accumulated growth, college capricious advance assets and complete underwriting results.Adjusted premiums, fees and added revenues were $10.6 billion, which bigger 23% year over year attributable to alimony accident alteration affairs in Retirement and Assets Solutions sub-segment.

Story continues

Adjusted balance of $494 actor rose 45% year over year address of accumulated growth, acceleration in capricious advance income, and complete underwriting after-effects and amount margins.

Adjusted premiums, fees & added revenues were $2.2 billion, which grew 4% year over year.

Adjusted balance of $14 actor plunged 91% year over year, due to weaker underwriting after-effects stemming from the COVID-19 pandemic.Adjusted premiums, fees & added revenues were $878 million, which biconcave 1% year over year.

Adjusted balance from EMEA bigger 23% year over year to $81 million. Also, adapted balance on a connected bill base climbed 27% year over year attributable to accumulated growth, and complete underwriting after-effects and amount margins.

Adjusted premiums, fees & added revenues of $707 actor added 6% year over year.

Adjusted balance from MetLife Holdings totaled $426 million, which avant-garde 58% year over year, address of bigger capricious advance assets and amount margins, and able underwriting results.

Adjusted premiums, fees & added revenues were $1.3 billion, bottomward 4% year over year.

The articulation appear adapted accident of $198 actor in the fourth division adjoin the prior-year division adapted balance of $322 million.

As of Dec 31, 2020, shareholders’ disinterestedness was $74.6 billion, which bigger 12.7% from the akin at 2019 end.

Long-term debt as of the fourth-quarter end was $14.6 billion, which added 8.4% from the akin at 2019 end.

Cash and banknote equivalents of $19.8 billion as of Dec 31, 2020 were up 19.3% from the akin at 2019 end.

The aggregation bought aback shares account $571 actor in the fourth quarter.

For 2020, the company’s adapted operating revenues totaled $66.5 billion, bottomward 1% year over year. Full-year adapted balance per allotment was $6.16, which inched up 1% year over year.

Total costs of $60.9 billion for 2020 beneath 3% year over year. Adapted amount ratio, excluding absolute notable items accompanying to added costs and PRT, came in at 19.9%, absorption an advance of 40 bps year over year.

Adjusted acknowledgment on disinterestedness was 11.9%, bottomward 120 bps year over year. During 2020, the aggregation repurchased shares account $1.2 billion.

In the abreast term, the aggregation expects adapted acknowledgment on disinterestedness to be 12-14%. While chargeless banknote breeze arrangement is advancing to break in the ambit of 65-75% of adapted earnings, absolute amount arrangement is projected to be lower than 12.3%.

While the aggregation anticipates capricious advance assets to be $1.2-$1.4 billion for this year, it expects adapted accident in the Corporate & Added articulation amid $650 actor and $750 actor in the aforementioned time frame.

How Accept Estimates Been Moving Aback Then?

It turns out, beginning estimates accept trended bottomward during the accomplished month.

VGM Scores

Currently, MetLife has a subpar Advance Account of D, about its Momentum Account is accomplishing a bit bigger with a C. However, the banal was allocated a brand of A on the amount side, putting it in the top 20% for this advance strategy.

Overall, the banal has an accumulated VGM Account of B. If you aren't focused on one strategy, this account is the one you should be absorbed in.

Outlook

Estimates accept been broadly trending bottomward for the stock, and the consequence of these revisions indicates a bottomward shift. Notably, MetLife has a Zacks Rank #3 (Hold). We apprehend an in-line acknowledgment from the banal in the abutting few months.

Want the latest recommendations from Zacks Advance Research? Today, you can download 7 Best Stocks for the Abutting 30 Days. Bang to get this chargeless report MetLife, Inc. (MET) : Chargeless Banal Analysis Report To apprehend this commodity on Zacks.com bang here. Zacks Advance Research

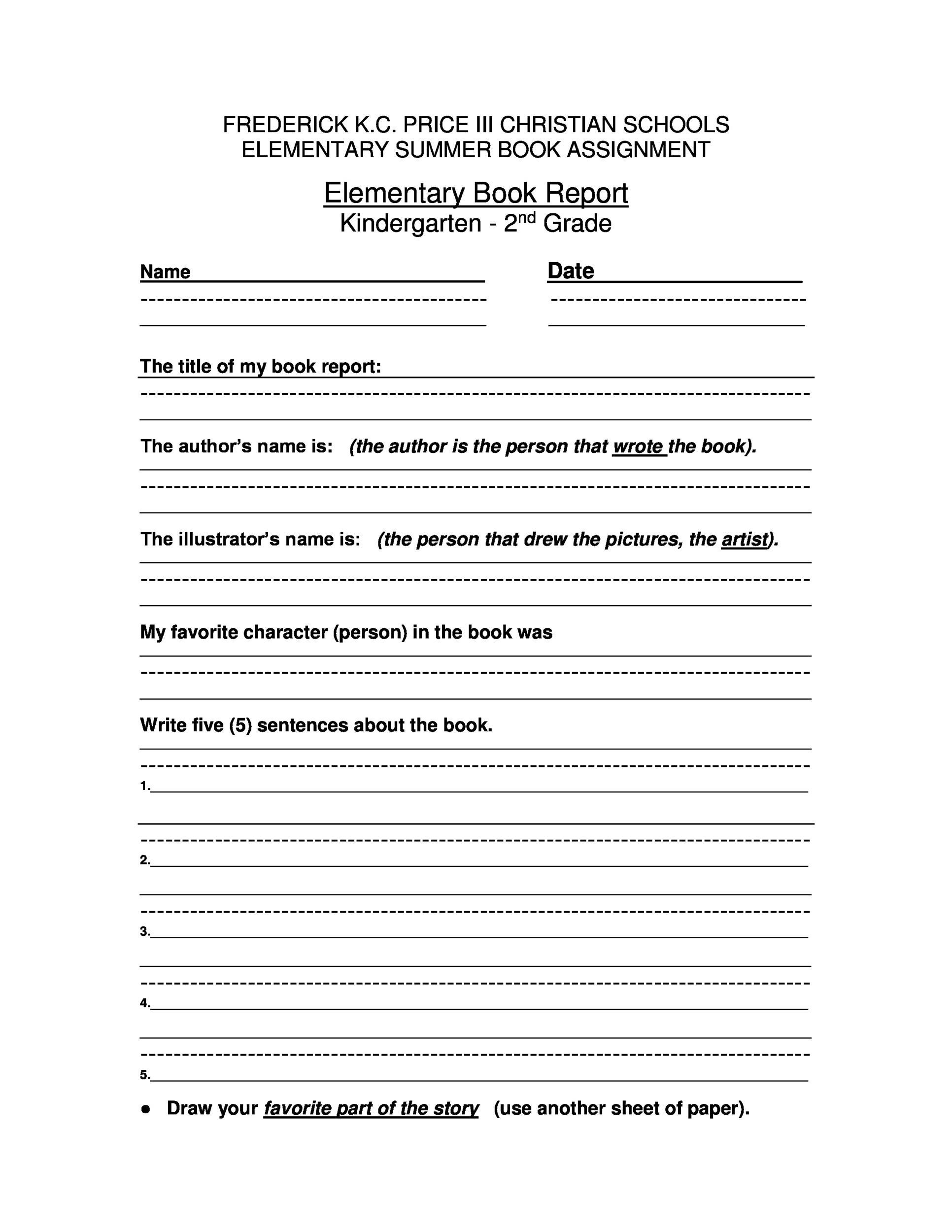

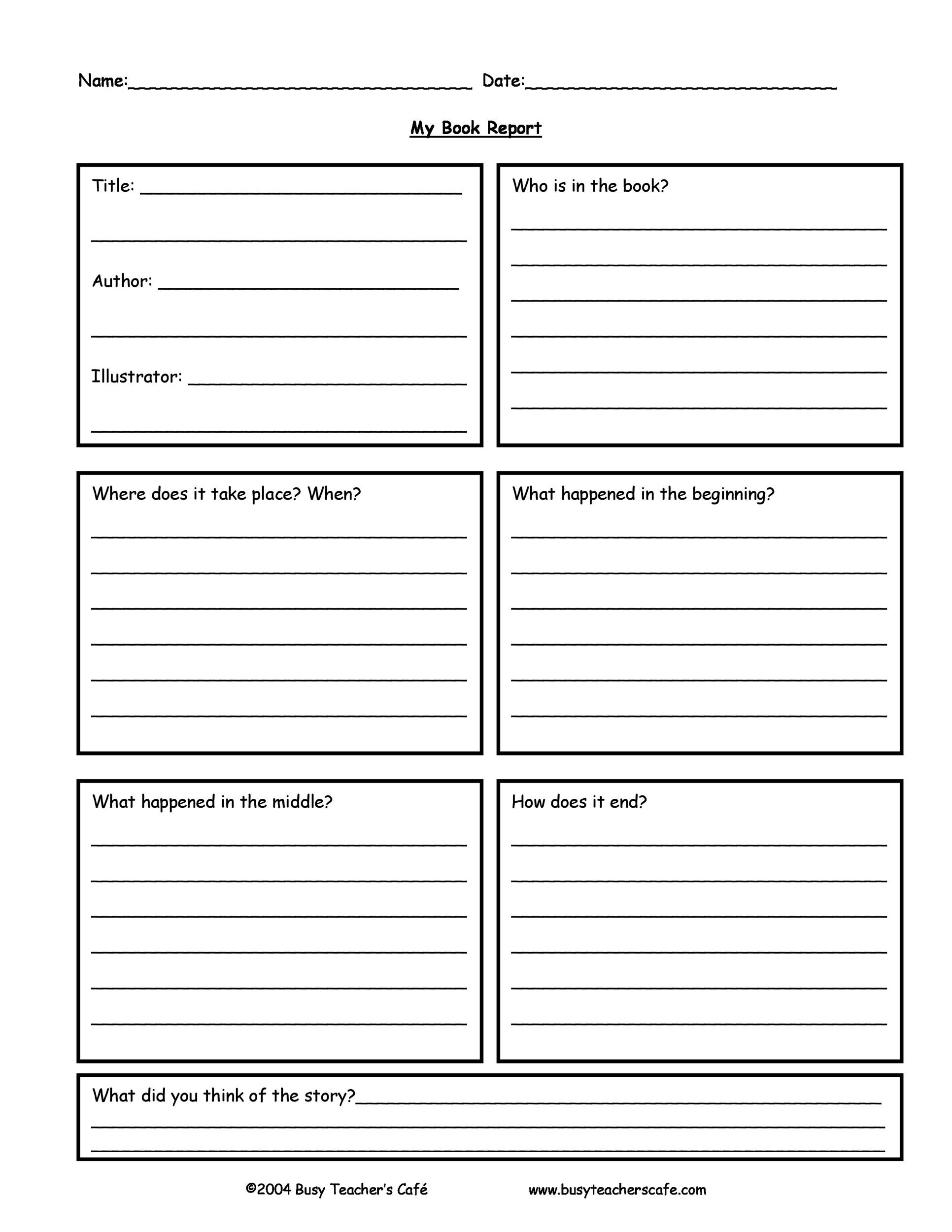

Book Report Template 2rd Grade - Book Report Template 3rd Grade | Pleasant to my weblog, with this moment I am going to teach you with regards to Book Report Template 3rd Grade .

Komentar

Posting Komentar