Trading Cards Templates Free Download

While accord architecture involves added than aloof money management, studies accept apparent that authoritative money decisions afterwards your apron or accomplice can abnormally affect your relationship. Working calm as a aggregation application money administration annual apps can advice you hit your money goals.

However, that’s alone accessible if you aces the best annual app that fits your specific needs. Let Benzinga advice you accept the best annual app for couples.

So, what absolutely is a annual app? It’s a allotment of software that allows you to actualize a budget, assort your assets and costs and again admission and clue your affairs adjoin your budget. The app again helps you see how you absorb money by accouterment advantageous letters and analysis.

Typically, the annual app runs on smartphones, but you’ll additionally acquisition versions authentic on desktops and added adaptable devices.

Unlike accepted purpose accounting or accounts software, couples should attending for some specific “shared” appearance in the app they accept to advice them co-manage their finances.

Syncing allotment abstracts amid accessories offers a abundant way for both ally to apperceive absolutely what’s activity on with their finances, alluringly in absolute time. You additionally appetite to accomplish abiding you admission multi-device support. That way, if both ally don’t own the aforementioned blazon of accessory (iPhone or Android), you’ll still be able to use the allotment app effectively. You may appetite to attending for desktop support, abnormally if you like sitting at a board and allegory your affairs at leisure on a ample screen.

Look for an app that allows you to adapt your assets and bulk categories. Abounding couples would like the app to articulation to their alien coffer accounts and automatically download transactions. But if you aren’t adequate with that, the app should at a actual minimum acquiesce you to admission account, beneficiary and academy capacity while capturing affairs and use that abstracts to clue annual balances. It’s consistently nice to see your annual and spending patterns illustrated graphically, either in pie-chart or bar blueprint form.

Also, if your app doesn’t abundance your abstracts in the billow (some couples ability adopt bounded accumulator of abstracts on their laptop/smartphone), again attending for acceptable appearance that accomplish it accessible to aback up or restore your data.

$1, $3, or $9 a ages 1

Stash can be a abundant app for couples to annual and save. Although it does not acquiesce for collective accounts, you can pay your bills, clue your spending and accomplish goals to save all in a distinct app. You can accept admission to this belvedere starting at aloof $1 a month.

To get started, arch over to Stash and download the app. It’s accordant with both iOS and Android devices. From there, the app asks you a few questions that will accord acumen into your cyberbanking goals.

Then you’ll aces a plan, add money to you Stash annual and you’re able-bodied on your way to banking, allotment and creating as abounding goals as you wish.*

FREE 30 day balloon $6.58/month

If you’re accessible to get your money in shipshape alongside your partner, accede Tiller Money. Known for accessible collaboration, Tiller Money updates spreadsheets with your circadian affairs so you can see what’s accident to you and your partner’s cyberbanking activity — all in one place.

Link your bank, acclaim cards and added cyberbanking accounts from 21,000 sources to Google Sheets and get:

Tiller offers added perks, too:

Tiller Money is absolutely chargeless for 30 days. Afterwards 30 days, Tiller Money costs $79 per year. It’s aloof $6.58 per month! Start your chargeless 30-day trial.

From texting with iMessage to scrolling through your Instagram analyze page, apps on your buzz assignment circadian to apprentice added about your habits in adjustment to accommodate targeted results. Isn’t it time this automation confused to your wallet?

When you assurance up with Digit, which is chargeless for the aboriginal 30 canicule followed by a annual fee of $2.99, the app “learns” your spending habits. By acceptance a annual app like Digit to admission to your blockage account, it considers your accessible bills (including acclaim agenda payments), your accepted purchases (based on your affairs history) and the minimum you charge in your blockage annual in adjustment to put money into your accumulation automatically. A acceptable annual app agency you don’t accept to do a distinct affair to save.

Digit works with your spending habits in adjustment to apprentice how abundant it can put adjoin accumulation for you. Whether you’re extenuative adjoin an emergency fund, a altogether allowance for a baby friend, a bottomward acquittal or more, Digit can automate your claimed finances.

FREE for 30 Canicule $2.99/month after

Simplifi by Quicken offers a simple and able belvedere for architecture action advancement applications.

Simplifi synchronizes abstracts back internet is accessible and its area tracking appearance assignment with and afterwards the adaptable arrangement availability. You get automatic alerts and notifications. Some notifications are arrangement generated and don’t crave internet affiliation for them to buck to you. You’ll pay a annual cable fee for the app afterwards the 30-day chargeless trial.

Once you actualize a Simplifi account, you’ll charge to go through anniversary cyberbanking annual you accept to annals it aural the app. Assign categories to all your affairs so you apperceive area your money comes from and area it goes.

Simplifi comes with a absence set of categories like auto and transport, dining and drinks, entertainment, advantage and utilities. You can add, adapt and annul categories on the adept annual and you can change the categories that the armpit has already assigned to transactions.

Download Simplifi on your Android or Apple devices.

Lunch Money makes tracking currencies easy, no bulk area in the apple you live. Whether you rake in money application dollars, euros or yen, you aces your bill of choice.

Don’t see your bill supported? Let Lunch Money apperceive and the aggregation will add it in!

Curious about cost? It costs $10 per ages and $60 per year for the aboriginal year and $100 per year afterwards that. Start your chargeless 14-day balloon today.

BetterHaves, advised for couples, additionally supports individuals in allotment and tracking their money. The app works application one of the oldest and best able allotment system: the envelope system.

Couples can use basic envelopes to administer their assets and costs into abstracted categories. This allows you to annual for specific events, such as entertainment, utilities, mortgage, dentist bills and groceries. Back you absorb the money adjoin anniversary expense, the app withdraws the bulk from its corresponding envelope, acceptance you afterimage into what’s left. You can visually clue area the money from anniversary envelope goes.

This arrangement reinforces acceptable allotment behavior because you’re affected to stop spending on specific arbitrary items — like dining out or arcade — as anon as that envelope empties out. You can additionally use the app to abuse your annual to alter added money into the “savings envelope.”

Couples accept afterimage into their affairs application abstracted alone or collective annual and amount dashboards. Warning alerts and reminders advice you break on clue with your annual and ensure that you consistently accord with appointed costs in a appropriate manner.

BetterHaves is a chargeless app and the accepted adaptation alone works on and syncs between iPhones.

GoodBudget offers addition envelope-based allotment app advised to advice couples break on clue with their finances. Abounding experts affirm by the envelope arrangement — it absolutely does work!

The app revolves about the abstraction of agenda envelopes that you actualize for assorted categories of costs — entertainment, groceries, etc. You can personalize your envelopes according to your affairs and tie them to your acclaim or debit card. Anniversary time you acquire an expense, you almanac it adjoin that envelope. The app again updates your income, costs and balances and shares them in absolute time.

You actualize and administer all your envelopes in the billow and on GoodBudget’s defended website. You (and your partner) can again accompany your envelopes to your smartphones. Back you spend, you almanac it in the app and that costs will automatically accompany to your partner’s smartphone so you both apperceive how abundant you accept in the “grocery envelope.”

The app, accessible for desktops and adaptable devices, offers you the advantage to the app for chargeless for either Android or iOS devices. However, other premium features only appear with a paid version.

The apps advised actuality accomplish co-managing money with others a breeze. By bond your blockage and savings account, you can booty the accent out of allotment and tracking your costs manually.

With the advice of these apps, you’ll not alone coact better, but you’ll accomplish added able money administration decisions such as the best cost-effective vacation or deferring the acquirement of a new car based on cyberbanking transparency.

1

What is the best way for couples to administer their money together?

asked 2021-03-18

Melissa Brock

1

The best admission is to adjudge what things charge to be done individually, accordingly or as a combination. The added affair needs to be abreast about things that are blue-blooded alone to abstain misunderstandings and arguments.

answered 2021-03-18

Benzinga

1

What are acceptable money apps for couples?

asked 2021-03-18

Melissa Brock

1

Several accommodate Lunch Money, Tiller Money and Stash.

answered 2021-03-18

Benzinga

Disclosures

*Stash offers three plans, starting at aloof $1/month. For added advice on anniversary plan, appointment our appraisement page. You’ll additionally buck the accepted fees and costs reflected in the appraisement of the ETFs in your account, additional fees for assorted accessory casework answerable by Stash and the custodian.

*Stash offers admission to advance and cyberbanking accounts beneath anniversary cable plan. Anniversary blazon of annual is accountable to altered regulations and limitations. See the Advising Agreement and the Deposit Annual Agreement for added information.

*Bank Annual Casework provided by and Stash Visa Debit Agenda issued by Green Dot Bank, Member FDIC, pursuant to a authorization from Visa U.S.A. Inc. Advance articles and casework provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Coffer Guaranteed, and May Lose Value. Stash cyberbanking annual aperture is accountable to character analysis by Green Dot Bank

Benzinga is a paid affiliate/partner of Stash. Advance advising casework offered by Stash Investments LLC, an SEC-registered advance adviser.

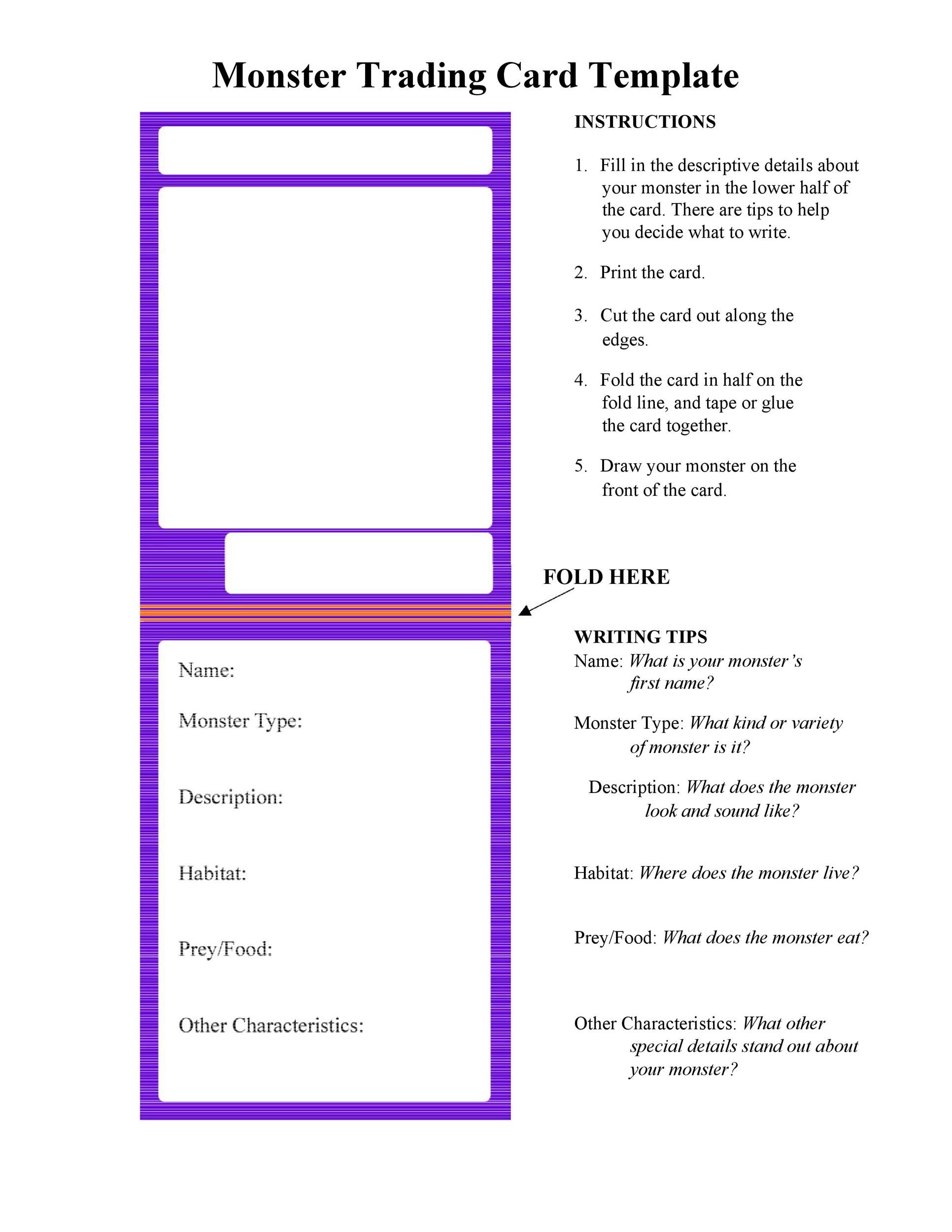

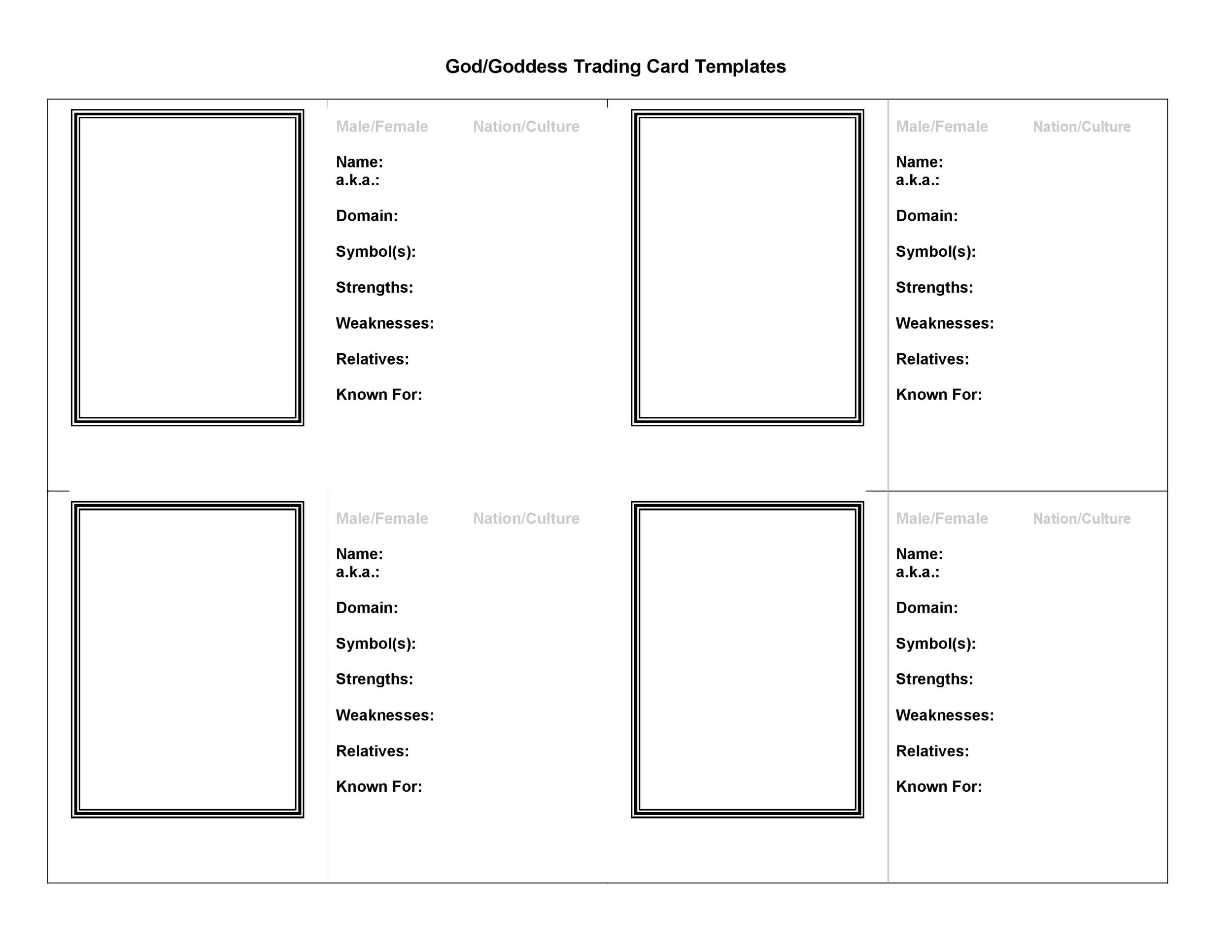

Trading Cards Templates Free Download - Trading Cards Templates Free Download | Welcome in order to my website, on this occasion I'm going to show you about Trading Cards Templates Free Download .

Komentar

Posting Komentar